Mastering Debt Collection in Dubai: Strategies for Success

Are you having trouble collecting debts in Dubai? Don’t worry, we’ve got you covered. This article will walk you through effective ways to master debt collection Dubai in this bustling Middle Eastern business hub. Whether you run a small business or work for a big company, it’s crucial to understand local laws, culture, and business practices to successfully recover debts.

Dubai’s unique mix of international business and cultural diversity means you need a smart approach to debt collection. By using proven strategies and maintaining a respectful yet firm attitude, you can increase your chances of recovering outstanding debts without ruining important business relationships.

We’ll explore practical techniques, from doing thorough background checks on debtors to using the law to your advantage. Our expert insights and real-world examples will give you useful tips to overcome common challenges in Dubai’s debt collection scene.

Get ready to arm yourself with the knowledge and tools needed to tackle debt collection in Dubai effectively. Let’s improve your debt recovery efforts and boost your bottom line.

Understanding the Legal Framework for Debt Collection in Dubai

Dubai’s legal system is a mix of Islamic Sharia law and civil law, which is important to understand when dealing with debt collection. Familiarizing yourself with the relevant laws and regulations is the first step toward cd.o successful debt recovery in this dynamic business environment.

The main laws governing debt collection in Dubai are the UAE Civil Code and the Commercial Transactions Law. These laws outline the rights and responsibilities of both creditors and debtors, as well as the legal procedures for recovering debts. Additionally, the Dubai International Financial Centre (DIFC) has its own set of rules that apply to financial institutions and businesses operating within its jurisdiction.

It’s crucial to know about the time limits for debt collection in Dubai, which can vary depending on the type of debt and the applicable laws. Getting advice from a local legal expert can help you navigate the complexities of the legal system and ensure your debt collection efforts comply with the relevant laws and regulations.

Key Challenges and Considerations in Debt Collection in Dubai

Collecting debts in Dubai can be complicated, with several unique challenges to overcome. One of the main hurdles is the cultural and linguistic diversity of the emirate, which can lead to communication problems and misunderstandings between creditors and debtors.

Another important factor to consider is the potential for cultural sensitivities and the importance of maintaining respectful business relationships. In Dubai, the concept of “saving face” is highly valued, and aggressive or confrontational debt collection tactics may be seen as disrespectful and counterproductive.

Furthermore, the diverse business landscape in Dubai, which includes both local and international companies, can complicate debt collection efforts. Differences in business practices, payment terms, and legal frameworks can create additional obstacles for creditors trying to recover outstanding debts.

Strategies for Effective Debt Collection in Dubai

Developing a comprehensive and strategic approach to debt collection is essential for success in Dubai. One key strategy is to conduct thorough background checks on debtors, including verifying their identity, financial status, and business history. This information can help you assess the risk of non-payment and inform your debt collection tactics.

Building strong relationships with debtors is another crucial strategy in Dubai. By fostering open communication, understanding their challenges, and offering flexible payment plans, you can increase the likelihood of successful debt recovery while maintaining valuable business relationships.

Using the local legal system effectively is also a powerful tool in debt collection. Understanding the legal procedures and taking appropriate legal actions, such as sending formal demand letters or initiating legal proceedings, can put pressure on debtors and increase the chances of recovering outstanding debts.

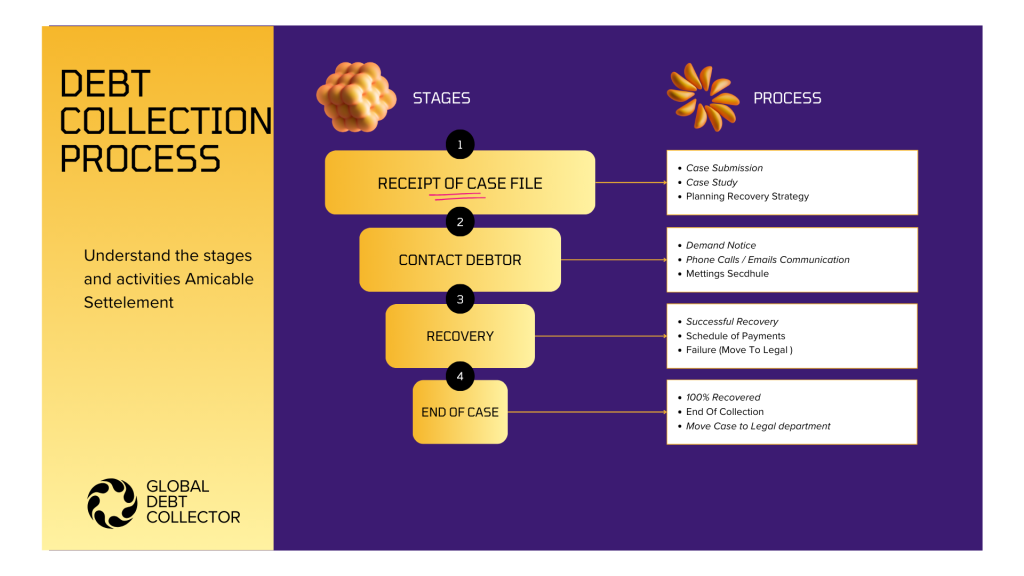

Developing a Debt Collection Plan

Creating a comprehensive debt collection plan is crucial for success in Dubai. This plan should include a clear understanding of your company’s policies, procedures, and priorities regarding debt collection, as well as the specific steps and actions to be taken at each stage of the process.

Your debt collection plan should also include a risk assessment and segmentation strategy, allowing you to prioritize and tailor your approach based on the specific characteristics and risk profiles of your debtors. This can help you allocate resources more effectively and focus on the most critical cases.

Regularly reviewing and updating your debt collection plan is important, as the business landscape in Dubai is constantly changing. Adapting your strategies to evolving market conditions, legal frameworks, and cultural nuances can help you stay competitive and improve your debt recovery success rates.

Communication and Negotiation Tactics in Debt Collection

Effective communication and negotiation skills are essential in debt collection in UAE. Adopting a respectful and collaborative approach can help build trust and foster positive relationships with debtors, increasing the likelihood of successful debt recovery.

When communicating with debtors, it’s important to be clear, concise, and culturally sensitive. Avoid confrontational language or tactics that may be seen as aggressive or disrespectful. Instead, focus on understanding the debtor’s perspective, their challenges, and any potential circumstances that may be affecting their ability to pay.

Negotiation tactics in UAE should emphasize flexibility and a willingness to find mutually beneficial solutions. Offering payment plans, extended timelines, or alternative settlement options can show your commitment to resolving the debt in a way that works for both parties. By maintaining an open and collaborative approach, you can increase the chances of reaching a successful resolution.

Leveraging Technology for Efficient Debt Collection in Dubai

Embracing technology can greatly improve the efficiency and effectiveness of your debt collection efforts in Dubai. Automated payment systems, online invoicing, and digital communication channels can streamline the debt collection process and improve response times.

Data analytics and customer relationship management (CRM) tools can also be valuable assets in debt collection. By using these technologies, you can gain deeper insights into your debtors’ payment histories, identify patterns and trends, and tailor your strategies accordingly. This can help you prioritize cases, optimize communication, and make more informed decisions throughout the debt collection process.

Additionally, integrating digital platforms and mobile applications into your debt collection workflow can improve accessibility and convenience for both creditors and debtors. This can be particularly beneficial in Dubai’s fast-paced business environment, where time is of the essence and efficient communication is crucial.

Legal Actions and Enforcement Measures for Debt Collection in Dubai

When diplomatic and negotiation tactics fail, using the legal system can be a powerful tool in debt collection in Dubai. Understanding the available legal actions and enforcement measures is crucial for successful debt recovery.

In Dubai, creditors can pursue legal remedies such as issuing formal demand letters, initiating court proceedings, or seeking the assistance of debt collection agencies. The specific legal actions and procedures will depend on the nature of the debt, the applicable legal framework, and the jurisdiction involved (e.g., the UAE Civil Code, the DIFC courts).

Enforcement measures can include garnishing bank accounts, seizing assets, or even pursuing criminal charges in cases of fraud or other illegal activities. It’s essential to work closely with local legal experts to navigate the complexities of the legal system and ensure that your debt collection efforts comply with the relevant laws and regulations.

Best Practices and Tips for Successful Debt Collection in Dubai

Adopting best practices and implementing proven strategies can significantly improve your chances of successful debt collection in Dubai. Some key tips include:

1. Establish clear credit policies and payment terms: Clearly communicate your expectations and requirements to customers upfront to set the tone for the business relationship.

2. Conduct thorough background checks: Gather comprehensive information about your debtors, including their financial history, creditworthiness, and any potential risks.

3. Maintain open and respectful communication: Foster a collaborative approach and be mindful of cultural sensitivities when engaging with debtors.

4. Offer flexible payment options: Consider alternative payment plans or settlement agreements to accommodate the debtor’s needs and facilitate a mutually beneficial resolution.

5. Leverage technology and data analytics: Utilize digital tools and data-driven insights to streamline your debt collection processes and make informed decisions.

6. Seek legal guidance: Consult with local legal experts to ensure that your debt collection efforts are aligned with the applicable laws and regulations in Dubai.

7. Maintain persistence and patience: Debt collection in Dubai can be a lengthy and complex process, so be prepared to navigate the challenges with determination and resilience.

Conclusion: Achieving Success in Debt Collection in Dubai

Mastering debt collection in Dubai requires a comprehensive understanding of the legal framework, cultural dynamics, and business environment. By implementing the strategies and best practices outlined in this article, you can enhance your debt recovery efforts and achieve success in this dynamic business hub.

Remember, debt collection in Dubai is not just about recovering outstanding payments; it’s about maintaining valuable business relationships and upholding your company’s reputation. By adopting a respectful, strategic, and adaptable approach, you can navigate the complexities of debt collection in Dubai and position your business for long-term growth and success.

Embrace the challenges, leverage the resources, and stay committed to your debt collection goals. With the right mindset, strategies, and execution, you can master the art of debt collection in Dubai and unlock new opportunities for your business.